At the time of writing this, I am procrastinating doing my taxes and am considering getting a tax extension.

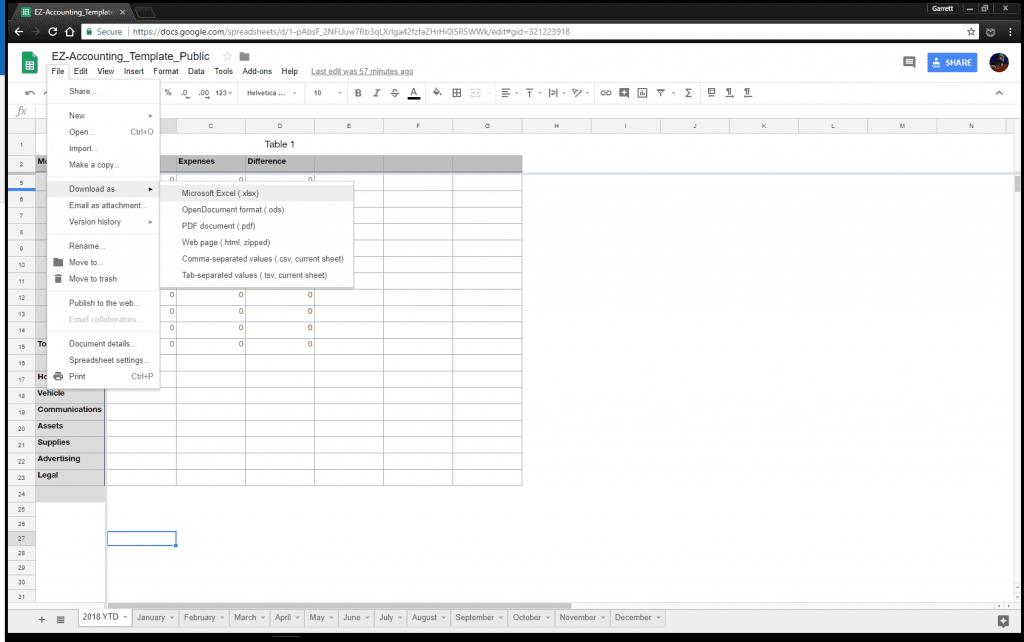

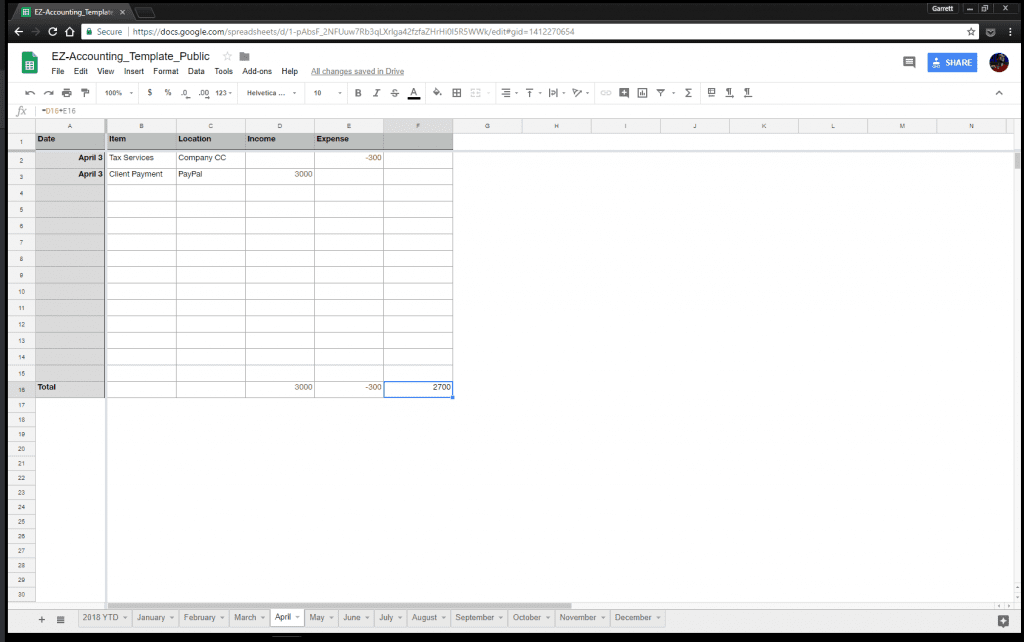

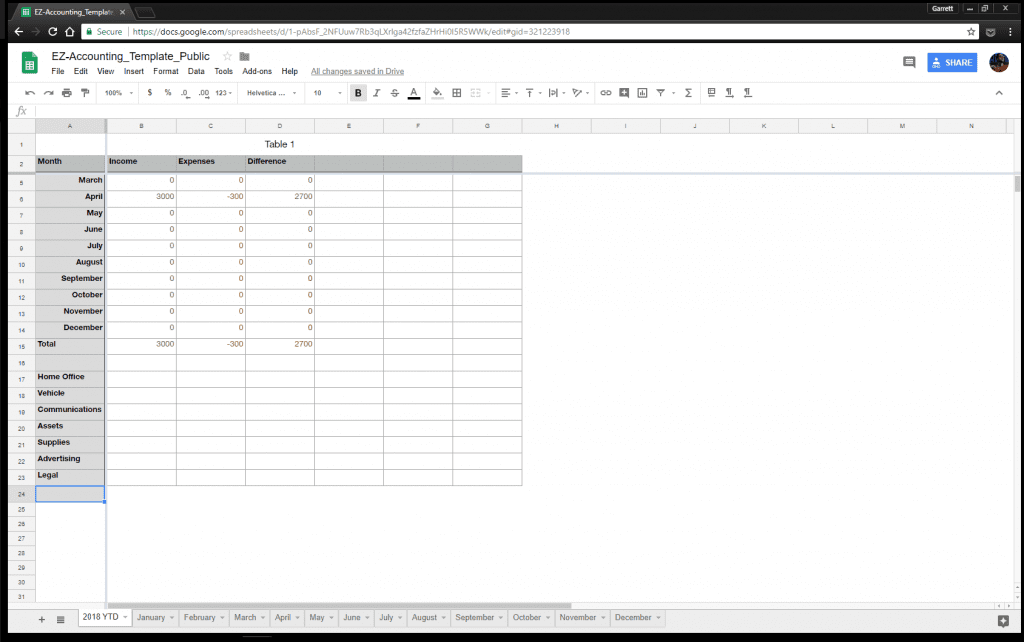

The good news is, I have a super simple accounting method I use, so it won’t be really hard when I need to do it.

That spreadsheet has saved me hours of headaches in the past, and will continue to do so in the future.

I could knock out my taxes this Saturday if I really want to.

Even still, I find myself wondering…is it worth getting a tax extension? What if I file the extension and then just do my taxes on time anyway?

I got one last year, and it seemed to work out well for me. Maybe there are some downsides I don’t know about.

I thought I should do some research.

You might need to know, too. This is what I found:

The Penalty

If you end up owing the IRS money, you will face a penalty for filing late, and a penalty for paying late, even with the proper tax extension form.

Or maybe you won’t pay the filing late fee if you get an extension.

To be honest, all of the articles I read weren’t clear on that.

Some say you get charged the late filing fee for not filing an extension, some say you get charged it even if you do file the extension.

Let’s err on the side of safety and assume we’re going to get the maximum charge.

The penalty is a 5% charge per month you are late paying. Luckily, this is capped at a maximum penalty of 25%. That’s still a lot of money, and probably why I owed so much last year when I filed in October!

Aside from that late fee, you have to pay interest. Currently, the IRS interest rate for underpayments is 3% annually.

However, if you’re an employee of a company and you’ve been paying your taxes with every paycheck, you should be getting money back.

Gee, it seems like the government almost doesn’t want to give you your money back, but will chase you down like the mafia if you owe them.

(Have I made it clear in this post and my last post that I really hate the government taking my money?)

You can file late, but still have to pay on time.

I want to make sure I make it clear: there are two penalty fees mentioned above.

One is for filing late, one is for paying late.

These are two separate fees and will still be incurred whether you file a tax extension or not (at least, that’s how I interpreted it).

On Form 4868 you will see that there is an option to pay some money now.

It’s a good idea to pay as much as you can towards your taxes (if you think you will owe).

This should keep them off your back long enough to get your shit together.

How to Apply for a Tax Extension:

Applying for an extension is really simple if you’re already using a service like HR Block or TurboTax.

Just log in and do it through their systems.

If you’re not you can download Form 4868, fill it out and send it in. All of the instructions are on the form.

I’ve been using TurboTax and HR Block since I was 18, alternating between the two based on what I need.

I heard there’s a new online HR Block service where you just send them info and then they call you with questions if they have any. Then they do the rest.

I’m going to check that out and if it works out for me, I will let you know.

Can your Extension be denied?

It can, but for that to happen you’d have to have really messed it up.

As long as you fill out and file the form on time (on or before tax day, usually April 15th), you won’t be denied.

Do make sure to keep copies of everything. I wouldn’t put it past the IRS to come after you and say you were late.

I bet they’d do worse things.

Does filing a tax extension increase your chances of being audited?

I seriously doubt it.

I know I haven’t been very nice to them in this post but I will give them this one thing.

There is no evidence that indicates you will be more likely to be audited if you file an extension.

My personal opinion is that you should do as much as possible to keep the IRS off your back.

Filing an extension and paying as much as you can by April 15th will keep you lower on, if not entirely off of, their radar.

Most experts in the articles I read said that if you’re making an obvious effort then the IRS will most likely leave you alone.

But also that filing an extension is not enough, as itself, to be the only thing that causes you to get audited.

If you’re going to get audited, there’s more going on with your account than just a tax extension.

How long does a tax extension last for?

Tax extensions used to end some time in August, and then you could file for a second one that would push you till October.

Now, they just go until October.

Most years, the date is October 15.

Can you file a second tax extension?

Yes, sort of!

The only way to get a second tax extension is if you apply to one (or more) of these circumstances:

- Involved in a recent and widespread natural disaster.

- One of these qualifying members of the military.

- A U.S. tax payer but are currently abroad.

I included links to more information on each situation because based on my brief little bullet points you can’t figure out if you actually do qualify or not.

Check them out if you think you might be one of those people.

Or, you know, just do your taxes on time.

What if you can’t pay your taxes?

My dude, I don’t even want to tell you about my situation here.

The IRS has a payment program you can sign up for. It’s pretty great and I have used it twice.

Because I need to be better with my money.

If you’re using a service like HR Block or TurboTax, they should have that option when you file your taxes. I know TurboTax does but I’m not sure about HR Block.

If you don’t use services like those, you’ll have to get your instructions from the IRS website.

I’m not going to retype them all up here for you.

God have mercy on your bank account.